Expertise

We are investing in large-scale strategic projects and technologies, enabling low-carbon hydrogen to play its full role in the energy transition, alongside renewable energies and electrification. With our investment funds, applying the standards of “article 9” of the SFDR regulation, we are contributing to scaling up the entire hydrogen value chain, from upstream, with the integrated production of renewables and hydrogen, through midstream, with conversion, storage, and distribution, to downstream, with applications in the industry, and transport and mobility sectors. We are also supporting the deployment of technologies and equipment that are critical to unlock the development of major hydrogen projects worldwide.

Infrastructure

We have closed the world's largest hydrogen fundraising round, raising 2 billion euros from +50 investors.

Our first dedicated infrastructure investment fund, the “Clean Hydrogen Infrastructure Fund”, has raised 2 billion euros and attracted over 50 investors from among the leaders in industry and finance. This fund is a unique instrument for supporting the growth of an industry that is key to decarbonization.

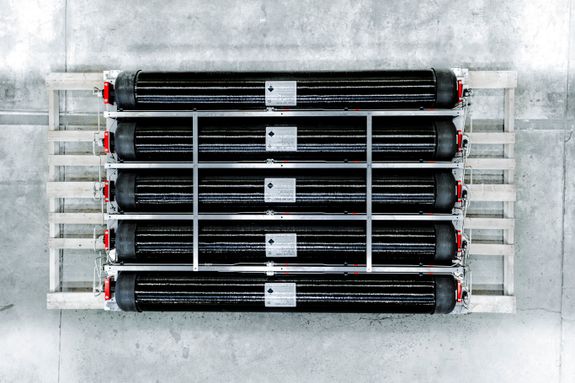

Equipment & technologies

Our second investment strategy aims to support and benefit from the massive expected growth in hydrogen equipment and technology manufacturing while boosting the most promising players in the industry.

With 1,600 large-scale hydrogen projects announced worldwide in May 2024, demand for equipment far exceeds available supply. The hydrogen supply chain needs to be multiplied by a factor of circa 100 to meet hydrogen targets. Our team of professionals aims to identify companies they believe have the potential to leverage industry growth through strategic moves, such as combining organic growth, expanding into adjacent sectors (external growth), or developing their geographic market footprint.

Towards a new asset class

“We are extremely grateful for the trust and support of our investors. The combination of Ardian’s unique investment and asset management expertise, FiveT Hydrogen’s industry knowledge, the diversity of our investors and our ability to leverage Hy24’s strong deal flow puts us in a unique position to grow this industry at scale into a decisive asset class.”

“We invest rigorously in our two strategies, with the aim of helping this new sustainable asset class to emerge. Both by applying the strictest environmental, social and governance standards, and by seeking strong economic performance for our investors. Our investment decisions are driven by the pursuit of value creation for all our stakeholders.”

A unique team

Made of over 45 professionals and operational partners based in Paris (headquarters), Zurich, Singapore and New York, our company was able to create a convergent vision at the crossroads of the financial and industrial worlds. Our teams bring together the best of experience and expertise in asset management, infrastructure, and private equity on the one hand, and in-depth knowledge of the hydrogen industry and project start-ups on the other. In addition to our ability to analyze the market and manage industrial projects, we have a thorough understanding of regulatory developments and public support policies for the industry.