Technologies and Equipments

Hydrogen equipment manufacturing represents a major investment opportunity across the globe, particularly in Europe, North America, and Asia-Pacific where there is strong appetite for reindustrialization and a just energy transition that will achieve both energy sovereignty and decarbonization. Our second investment strategy aims to tackle this equipment and technology manufacturing challenge and to boost the players we believe are the most promising in the industry.

The clean hydrogen equipment and technologies strategy

With 1,600 hydrogen projects announced worldwide as of May 2024[1], demand for equipment far exceeds available supply capacity. The hydrogen equipment manufacturing capacity across the entire supply chain needs to be multiplied by a factor of circa 100 to meet global hydrogen development targets[2]. From upstream to downstream, the manufacturing of all the components of the low-carbon hydrogen value chain therefore needs rapid acceleration. The equipment market is estimated to reach USD 190 billion by 2030[3].

The second investment strategy developed by Hy24 focuses on technology and equipment scale manufacturing. Our team designed the “Clean Hydrogen Equipment Fund”, an investment vehicle dedicated to the whole clean hydrogen equipment supply chain: from upstream suppliers of production equipment (e.g. electrolysis), to downstream equipment suppliers for hydrogen usage (e.g. fuel cells) as well as midstream equipment suppliers for conversion or logistics (e.g. storage). Our fund — open to professional investors only — is classified under the “article 9” of the SFDR regulation, applying to funds that have set themselves the objective of investing solely in sustainable assets with social and environmental objectives, for the benefit of the energy transition.

Through this fund, we are supporting companies in the hydrogen sector that we believe can become leaders in their market segment and its respective supply chain, with proven expertise and solid management teams. Our team of professionals aims to identify companies that have the potential to leverage industry growth with strategic moves combining organic growth, expansion into adjacent sectors (external growth), or the development of their geographic market footprint. We are using our unrivaled experience and extensive network in the hydrogen sector to help these companies grow. Our equipment fund can leverage advisors and operating partners who bring on-the-ground industrial experience and extensive networks, having worked with more than 100 players in the hydrogen industry, and having acquired in-depth knowledge of both the industry and regulatory landscape.

Initial support for the equipment manufacturer Hexagon Purus

As part of our second strategy aiming to boost and consolidate low-carbon hydrogen equipment and technologies providers, we invested into the Norwegian player Hexagon Purus.

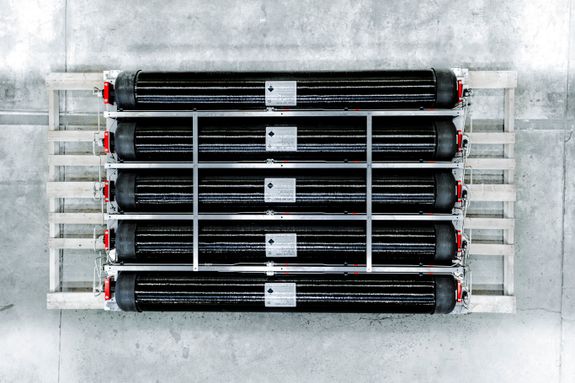

Hexagon Purus is a leading player in the hydrogen infrastructure and zero-emission mobility sector. The company’s hydrogen systems based on Type 4-cylinder technology enable safe and efficient use of pressurized hydrogen for a wide variety of applications from infrastructure to transport with trucks, buses, trains, and ships. This investment was the first made through our “Clean Hydrogen Equipment Fund” and closed in January 2024. Hy24’s investment (which amounts to around 13 million euros for the equipment fund) and expertise will support Hexagon Purus’ global equipment and solutions manufacturing scale-up plans, enabling it to meet growing demand for hydrogen supply chain components.

Our commitment to pivotal hydrogen technologies

“This first investment made by the “Clean Hydrogen Equipment fund”, reinforces Hy24’s position as a strategic investor and a catalyst in fostering the low-carbon hydrogen economy. It bolsters the growth initiatives of Hexagon Purus, a global leader in the midstream of the hydrogen sector, reflecting our fund’s commitment to the mature and pivotal hydrogen technologies that are essential to decarbonizing industry and mobility sectors.”